The Great Disconnect

Between how aspirants learn from the best in normal domains vs in stock-markets.

Picture a talented young batsman, who has done well at local level, aspiring to play Test cricket for India. How would he work towards his goal? Apart from the daily grind of coaching, practice, fitness and matches, he is likely to ask:

Who has achieved the most in this domain & what can I learn from their ways?

He will figure that three stand out – Gavaskar, Tendulkar, Dravid – for having scored over 10,000 runs at over 50 average. As he studies their game, he will also realize how much the three have in common on classical technique, temperament, discipline, knowing where off stump is, which balls they choose not to play etc. While styles differ, what is common overwhelms what is different.

As he stares at India’s current Test team, he will notice that the more accomplished batsmen – Rohit, Virat, Pujara, Rahane – play their Test cricket in the same mould as the three GOATs. As does the latest talent, Gill. Even the ones who play very differently in T20 or One-day format seem to magically converge onto the timeless GOAT approach when they wear whites. The smart, driven young man realizes that his best odds lie in aligning his Aspirant Way with the GOAT way. And he sets off doing exactly that over the next many years.

Now, switch to investing. GOATs are clear, based on the numbers. Only one Twosome has turned nothing into $700 billion of value, with no one else even coming close. That Awesome Twosome, in turn, followed the path laid by another GOAT. Assuming that aspiring investors are smart and driven to achieve excellence in their domain just like the aforementioned sportsman, one would assume that they would align their ways to the GOAT way. Even if there is some deviation, it is reasonable to expect a decent degree of overlap. Generously, GOATs have left detailed descriptions and track record spanning many decades, making aspirants’ task even easier.

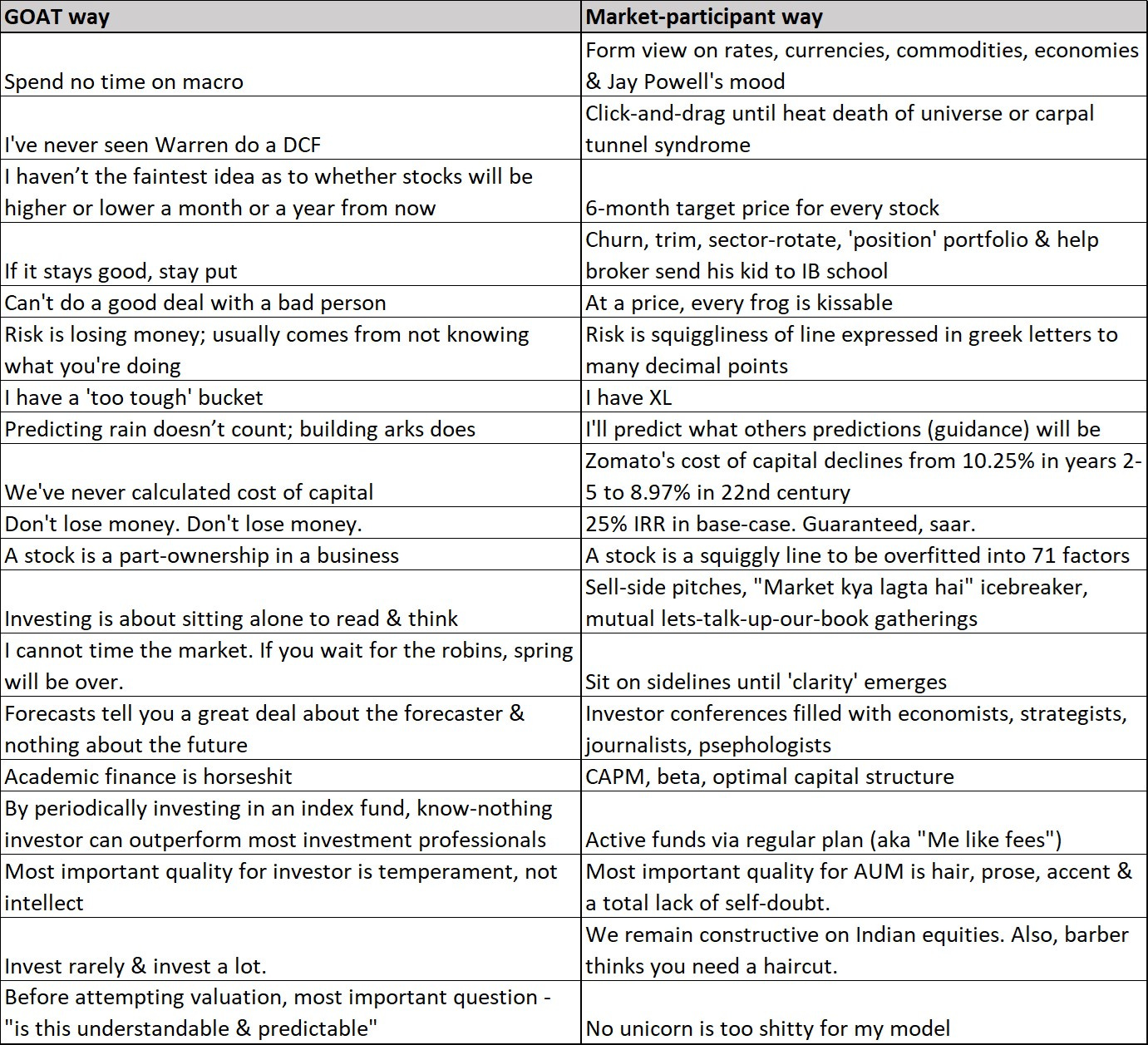

Unfortunately, a reality check reveals the exact opposite to hold true. Here is how investors’ typical approach compares to that of the most distinguished in our domain.

In total contrast to Test cricket (or a different domain you may choose as your analogy), there is a 180-degree divergence between Aspirant Way and GOAT way. This is what I call the Great Disconnect of investing, something that I have never been able to make sense of. It is as if we can clearly see how Gavaskar-Tendulkar-Dravid have played and yet, choose to play Test cricket the way Rahul Tripathi plays T20.

Why? Go figure, as I have no clue. Buggy humans, bah.

Such an instructive post. Thanks for writing and posting - very valuable. Goat Vs Regular table is golden.

Do you think the original GOAT philosophy will hold true for the next say 100 years? Is value investing timeless? or new philosophies will emerge as the markets evolve?

For eg : assessing intangible value of tech companies ( and the often lopsided valuation associated with them) ?