Vaccicorns: An improbable rescue mission

Global vaccine makers are closer to Unicorns than to Pharma companies as we know it. Looking at their journey, without hindsight, reveals how improbable, risky and lucky it’s been.

As I read global vaccine company filings for my “Makers Keepers” essay, there was a sea of difference between them and Pharma businesses that India is familiar with, including our homegrown vaccine makers. This isn’t news to experts. However, a novice such as myself found it almost unbelievable that a few small, unproven companies ended up saving the world. When viewed without benefit of hindsight, it’s an improbable, fascinating story.

Today, Moderna or Biontech are household names. But what were they like before covid? Let’s rewind to early-2020. Covid’s still not a thing, but school-buses are (sigh). Look at four leading protagonists of the story about to play out: Moderna, Novovax from USA and Biontech, Curevac from Europe. I chose them as, over 2020, these four received nearly $5 billion from US and German governments. Company filings from early-2020, which discussed 2019 performance, said the following about these four companies (mild paraphrasing):

· We are clinical-stage bio-tech companies.

· No medicines using our approach have ever been approved by FDA or anyone else.

· We have never commercialized any pharmaceutical products whatsoever.

· We have no marketing or sales organization. No commercial manufacturing either.

· We have incurred net losses in each year since our inception (1987 for Novovax, between 2000 and 2010 for other three).

· Our accumulated losses are massive.

· We have financed our operations primarily through equity securities and strategic alliances.

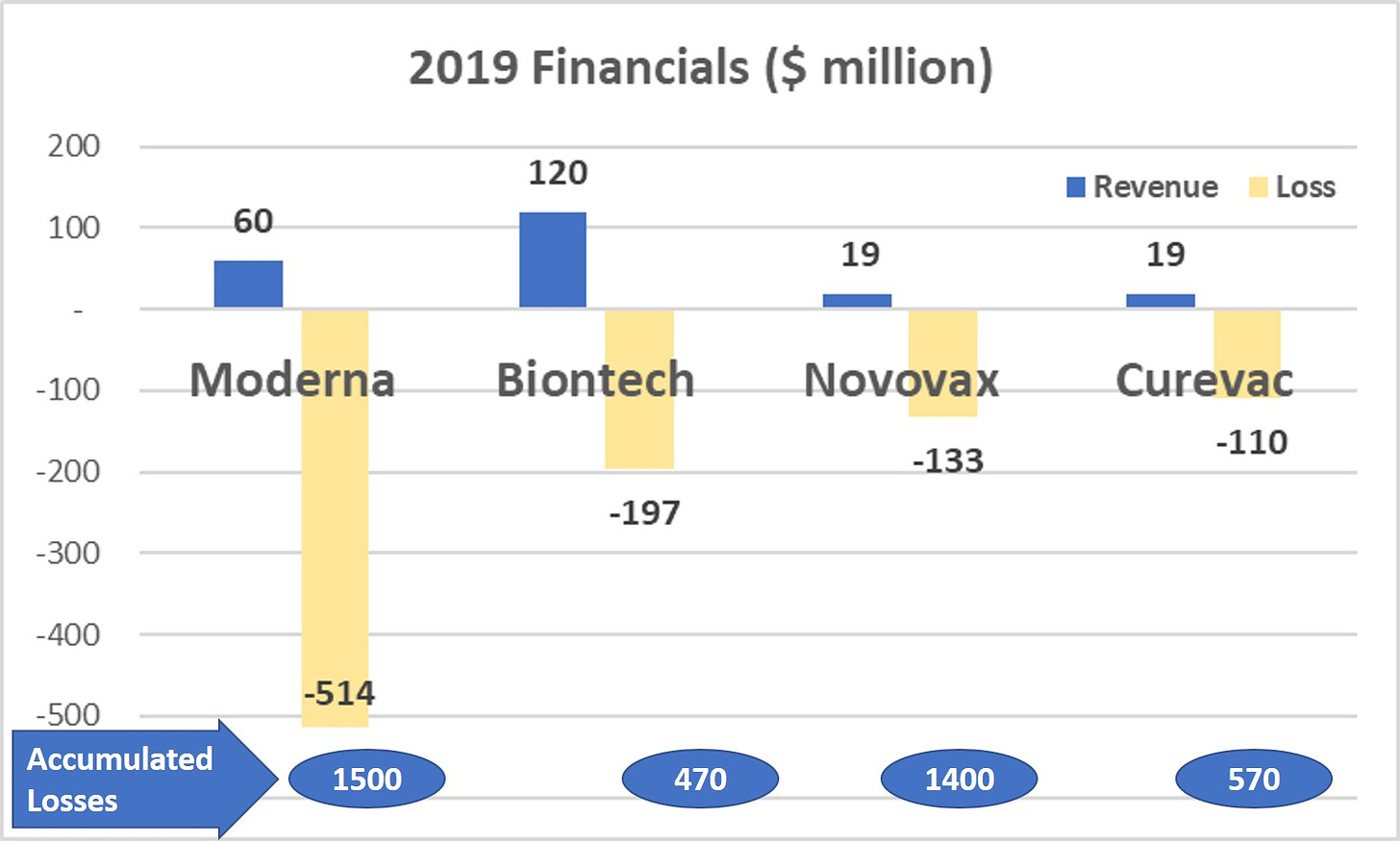

Lest you think I’m exaggerating, here’s their 2019 financial snapshot.

Don’t get me wrong. I’m not belittling them. Above aspects are features, not bugs, of an established business model. These are R&D companies at the cutting edge of their respective bio-tech niches, with hundreds of pioneering scientists working on long-gestation projects that could transform the face of healthcare. They use specialized expertise to function as an extended product development arms of Pharma giants through strategic alliances. They’re meant to incur R&D expenses well in excess of revenue for over a decade, to be recouped if a few products fructify. While they’re initially funded by venture capital and private equity, all four became publicly listed companies well ahead commercialization. Short-termist markets financed their moon-shots.

Now, enter covid, exit school-buses. Every company with relevant skills started working on a vaccine. Over first half of 2020, US government funded their best prospects through Project Warp Speed. Some were giants – Merck, Sanofi, GSK, AstraZeneca, J&J. Two were from above list of minnows – Moderna, Novovax. Similarly, Germany funded the other two: Biontech and Curevac.

Outcome. Every giant failed or struggled with timing or scaling. Two minnows, who had never made product or profit, ended up making over 2 billion doses and $30 billion revenue in the following year (one of whom admittedly partnered with a giant). And, ended up saving the world, starting with the West. This is the most improbable, high-risk, serendipitous rescue mission I’ve ever come across, not counting that one where Bruce Willis exploded a nuke on an asteroid (which, by the way, acted better than any cast member).

Story apart, a few contextual aspects stand out, with implications for India.

Ecosystem

It’s impossible for a group of scientists stepping out an R&D division in India to get funded for an entrepreneurial journey requiring two decades of financial support with no assurance of success. Western ecosystem, across private & public markets, government grants and charitable foundations, funded them and how. Three of above four were valued at roughly $10 billion well before covid prospects were baked in. Cumulative funds raised was over $7 billion. Implausibly, short-termist markets made their peace with quarterly filings that read like scientific papers. Supporting bio-tech unicorns at scale feels like society paying option premiums every year, for a windfall gain in an occasional crisis. That this was mostly done by free markets and not government is noteworthy.

While I have made snide remarks about our not-for-profit unicorns, I’m less inclined to do so now. I’m not establishing equivalence to funding advertising/discounts or lifesaving nature of getting food from Papa Pancho Da Dhaba in 30 minutes. There is value to having an ecosystem that can channel sizeable funds to long-gestation projects without obsessing over short-term profits.

Discourse

At a headline level, I never saw emphasis placed on “Hey, they’ve never made a vaccine before” or “We’re guinea pigs on untried technology”. By and large, discourse focused on vaccine-efficacy in trials, not history (or lack thereof) of vaccine-makers. To quote Batman, “It's not who you are underneath, it's what you do that defines you”. Contrast this with Indian media discourse. Companies with decades of experience and billions of doses, using more established technology, are treated with undeserved scepticism and sensationalist fearmongering. While vested interests are unavoidable, a high-stakes issue needs more responsible discourse.

Backing

Picture Indian government punting a few billion dollars on bio-tech start-ups with no history of commercialized vaccines in mid-2020. Half the companies thus funded in the West have little to show for it. Other half assure supplies to their home markets, but charge a price that implies near-50% pre-tax margins despite all capital/research expenditures having been funded upfront by government. There’s no moronic ‘profiteer’ tag or accusations of Trump doing favouritism. A long time after 1991, we struggle to appreciate and back private businesses and their profits.

Everything is a function of context. Lifesaving vaccines and the improbable companies that made them in record time emerged out of a context rich in enablers. Much as “Makers Keepers” sounds harsh on countries retaining 90% of vaccines, those are the only countries where such Makers were conceivable. Especially as improbable Makers turned out to be underdogs nurtured for years on the basis of potential, not performance. While how much Makers should keep is a reasonable question, it’s far more important to ask how we do better to nurture our next generation of Makers.

No Make, No Keep.

Sources: Company filings mentioned in https://buggyhuman.substack.com/p/makers-keepers-what-can-we-learn

Thanks Anand..great read!

Super.. thanks for posting....